Business Expenses Deduction 2024 Tax – Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . According to the IRS, though, an audit is simply a review of your accounts “to ensure information is reported correctly according to the tax laws and to verify the reported amount .

Business Expenses Deduction 2024 Tax

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comTax Deduction Definition: Standard or Itemized?

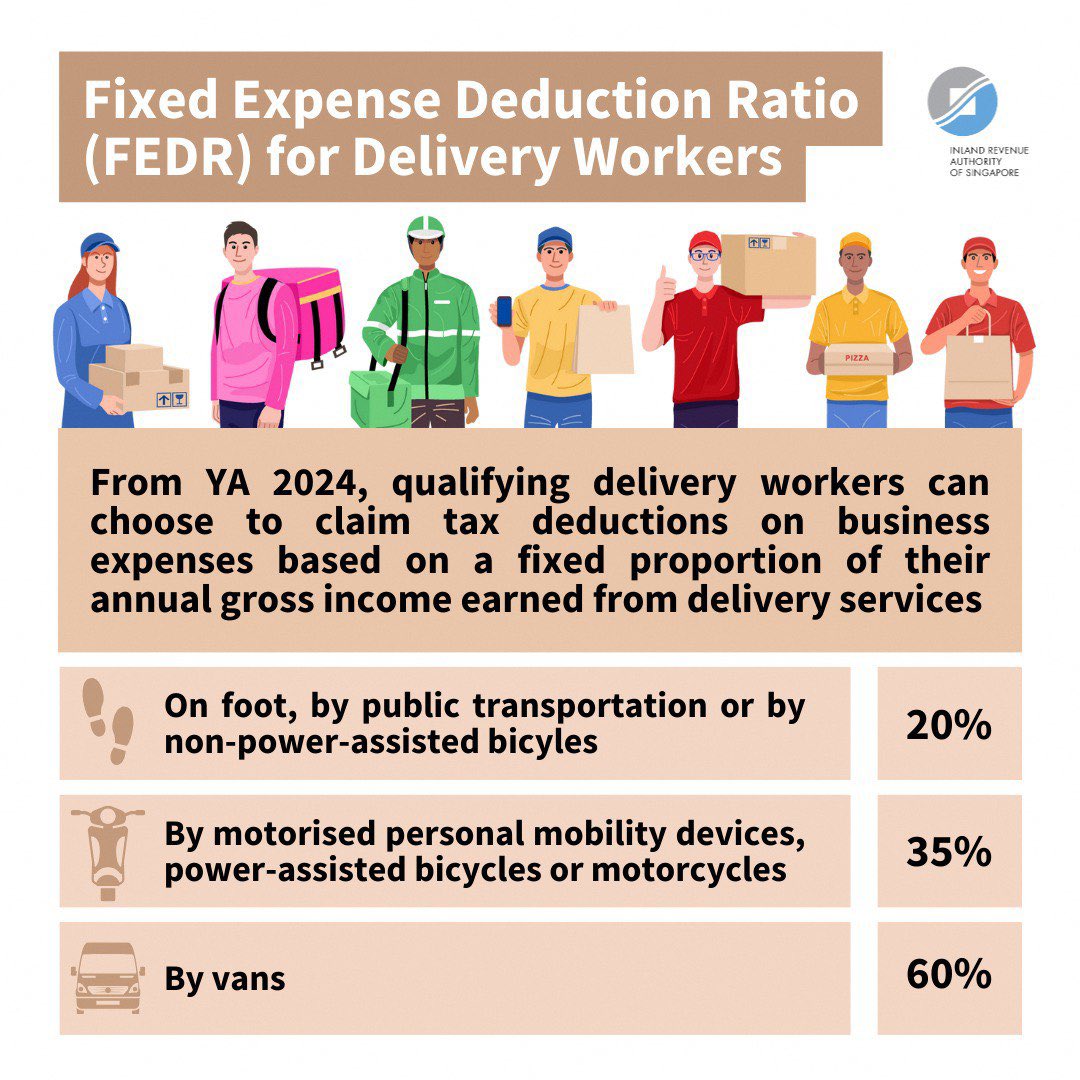

Source : www.investopedia.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgBusiness Expenses Deduction 2024 Tax 25 Small Business Tax Deductions To Know in 2024: Ready or not, the 2024 tax filing season is Among them are higher standard deduction amounts, expanded income tax brackets and changes to business deductions. When filing your taxes, you . On January 31, 2024, the United States House of Representatives passed the Tax Relief for American Families a taxpayer is generally able to deduct interest expenses attributable to its trade or .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

More Stories

Orange County Holidays 2024

Evanescence Tour 2024 Usa Eclipse

Spring Break Dates 2024 Usa Presidential